Balancing between tactical and strategic investments

11 Dec 2018 • Strategy & Business Design

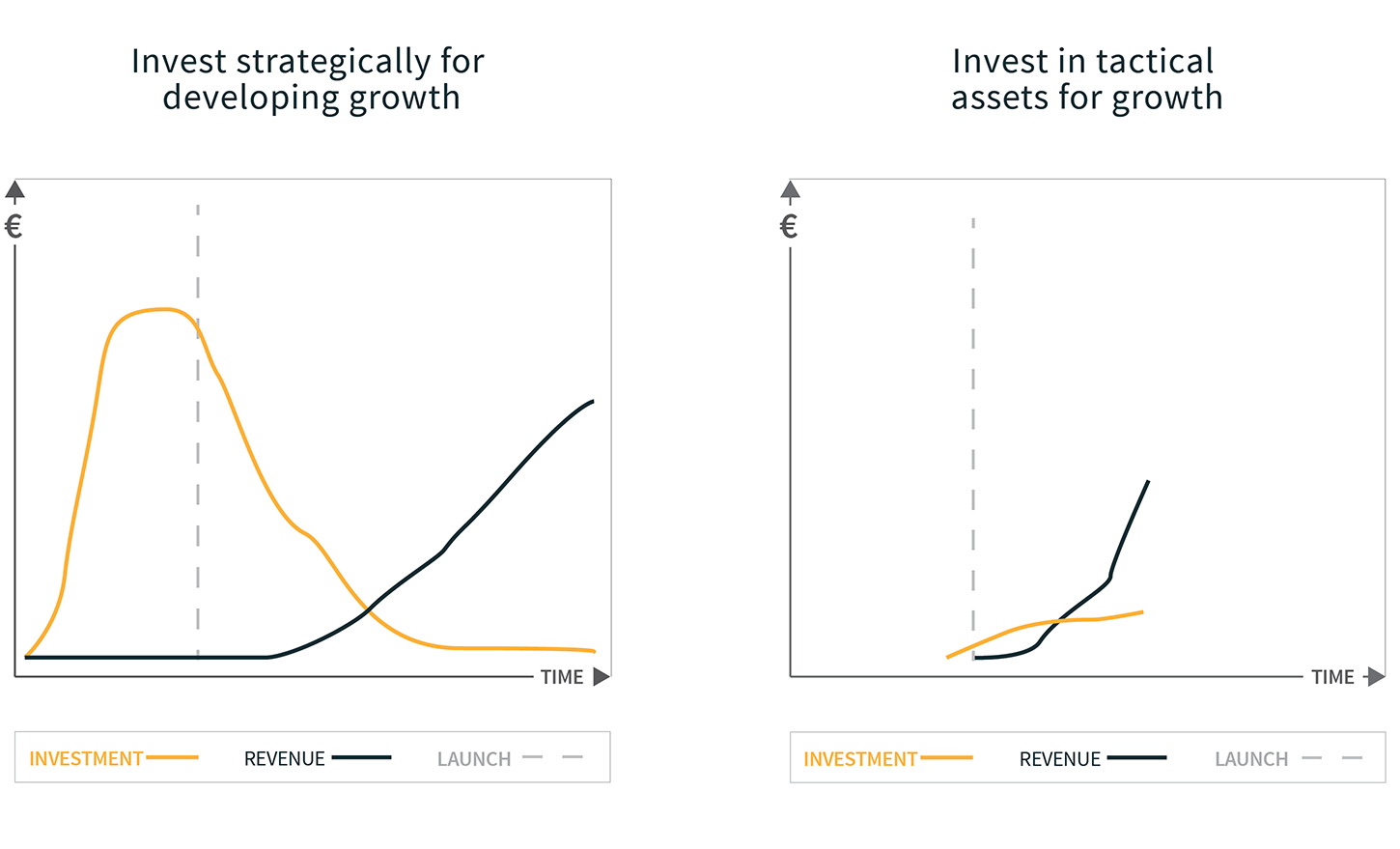

Sometimes companies seem to invest easier in long term concrete digital business development with only rough ROI estimates compared to short term tactical assets that will impact revenue more quicker. So what’s the trick balancing between tactical and strategic investments?

It is obvious that you need to invest in both, but how to make sure investments are in balance and adequate?

What are the tactical assets creating growth?

Tactical assets are continuous activities that will make your sales channel or marketing platform to attract more customers, increase revenue and decrease churn. These activities require investing in your own cross-functional growth team by adding resources and developing competencies. The fact is that no sales channel or marketing platform will automatically generate sales. You need to invest in optimizing them.

These tactical assets will give you all necessary insights and assurance for any further long term investment. Your long term investment will have substantially better changes to succeed if these activities are executed right.

Make sure you have the right technology and a team who know how to make the best out of it. Digital tools and solutions do not give you any advantage without a proper understanding on how to use them effectively to engage customers. Use external partners to fill in the lack of skills if necessary.

Strategic investments creating growth

These are long term development projects that will take time and money but will enable you to stay in business and give you competitive edge against your most fierce competitors.

Competitive edge can be created through increased efficiency, radical ease of use, unique offering, pricing, positive network effects etc.

Digitality and Return on Investment (ROI)

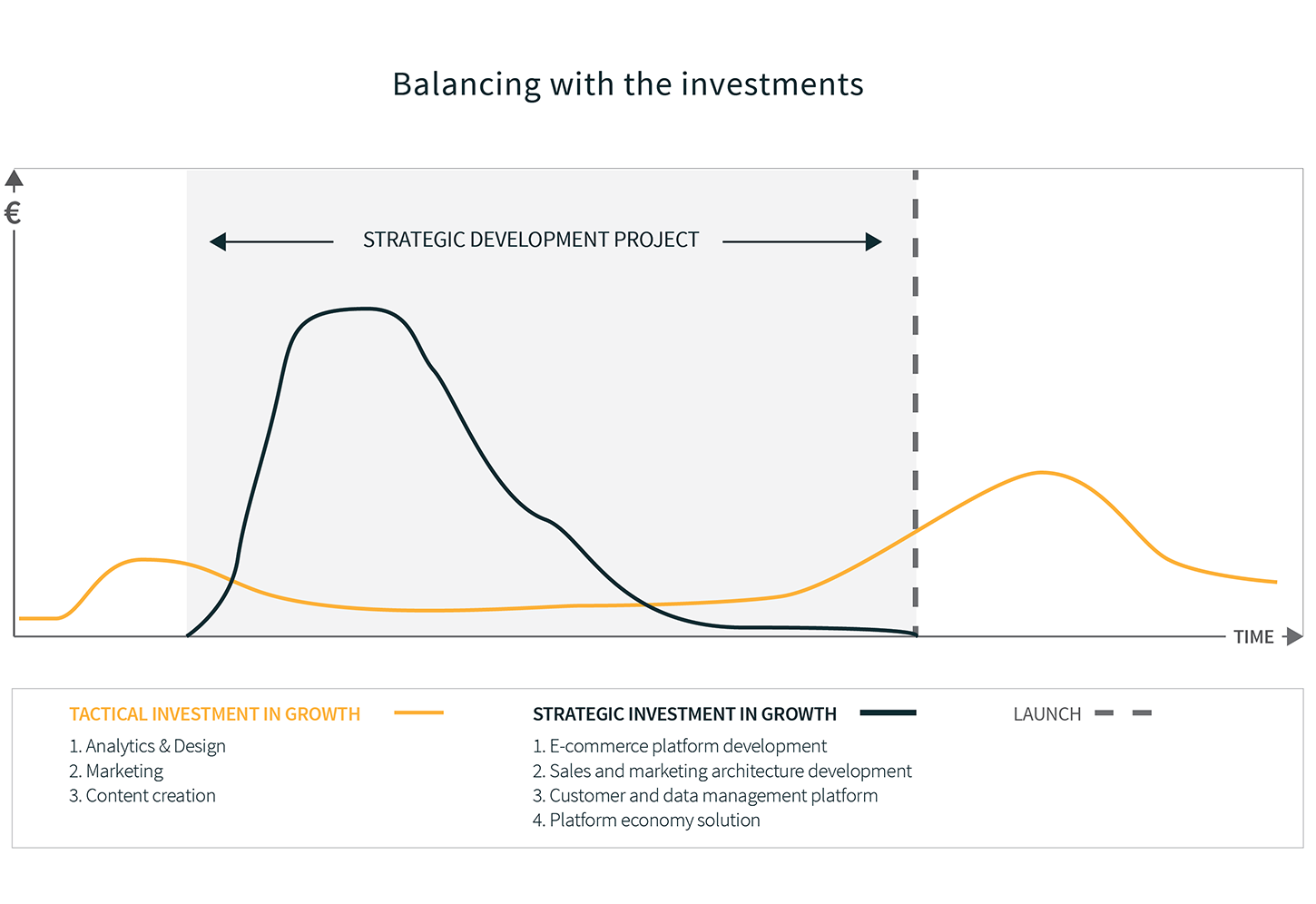

Investing in tactical assets to make the best out of your current system will impact on revenue and deliver ROI in 2-8 months. When executed correctly these assets will also give you clear understanding on what works and what does not to and why.

Investing strategically in long term growth, in development projects to build competitive edge and enable you to stay in business will take longer time to impact on revenue and deliver ROI in 1-3 years.

Without support from the tactical assets these long term strategic development projects will most likely fail.

Balancing the tactical and strategic investments

I strongly recommend our clients to start with investing in strengths, in their own cross-functional team which focuses on growth. These assets are a working continuously towards impact on revenue and building customer understanding which work as the basis in the long term development projects.

I would not encourage any of our customers to invest in e-commerce platform development or in any long term development projects without first understanding how valuable the short term assets support is for the success of the longer development project.

Challenges with unbalanced investments

Without a solid understanding on how to balance investments and how tactical assets can affect sales and revenue companies end up in buying projects and assets randomly from external partners without any positive effects on revenue.

1. The investment decisions are made in different forums. Working in siloes and not as one cross-functional growth hacking team.

2. The tactical assets are quite often seen as expenses rather than investments. Sometimes it is easier to justify the strategic and concrete long term investments.

3. Company culture does not support ”building, testing and learning ” activities and people are afraid to fail. More about Lean startup – build measure and learn

4. Most of the tactical assets needed for building growth are not traditionally included in companies own skill set. Companies struggle and fail in finding the right external partners to match their needs.

Want to ensure you have the right balance in investments for growth? Contact us & our expert will help you.